What is title insurance?

Did you know that 92% of North American homeowners hold title insurance? That is, throughout North America, with the exception of Quebec, where only 4% of owners opt for this type of insurance coverage.

If homeowners around the world have understood the importance of protecting their real estate through title insurance, there is no reason why Quebeckers shouldn’t be allowed to fully protect their properties.

If homeowners around the world have understood the importance of protecting their real estate through title insurance, there is no reason why Quebeckers shouldn’t be allowed to fully protect their properties.

Home Insurance Doesn’t Cover Everything…

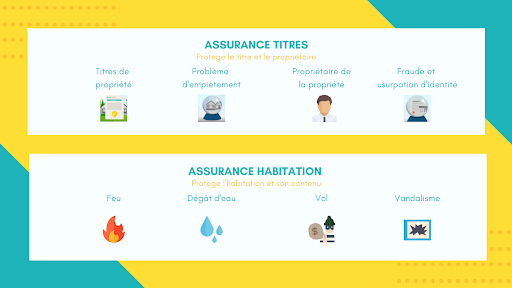

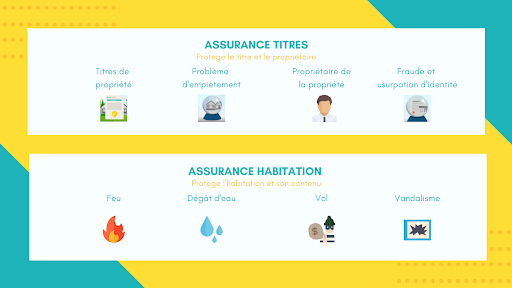

But why opt for title insurance in addition to your home insurance? The reason is simple: these two insurance products do not cover the same things. Title insurance protects the title to your property. It insures the document that certifies that you are the actual registered owner for an address where you hold real estate property and it protects you from issues related to this title. An insured property can be an apartment building with 6 units or less, a house, a cottage, a lot, etc. Home insurance, on the other hand, protects the structure and content of your home, and cannot be used for title-related issues.

Therefore, in order to optimize their coverage, homeowners generally should purchase both types of insurance. Fortunately, title insurance is much cheaper than home insurance.

Therefore, in order to optimize their coverage, homeowners generally should purchase both types of insurance. Fortunately, title insurance is much cheaper than home insurance.

What Is a Title?

In order to understand exactly what title insurance is, let’s begin by defining what is a title entails.

A title, also known as a property deed, consist in an authentic, notarized act that proves your status as an owner. It establishes the rights of an individual or company to own and enjoy their real property. It clearly and accurately defines the estate.

Whether the land holding (land, building, etc.) was acquired as part of a sale, donation, purchase or estate, the notary responsible for drafting the title will publish the deed in the Quebec Land Register. This proves that you are, indeed and without any doubt, the owner of the property. When you purchase title insurance, which you pay for only once for your property, you will be protected against several nightmare scenarios; you will be protected against title defects that could impact your property.

A title, also known as a property deed, consist in an authentic, notarized act that proves your status as an owner. It establishes the rights of an individual or company to own and enjoy their real property. It clearly and accurately defines the estate.

Whether the land holding (land, building, etc.) was acquired as part of a sale, donation, purchase or estate, the notary responsible for drafting the title will publish the deed in the Quebec Land Register. This proves that you are, indeed and without any doubt, the owner of the property. When you purchase title insurance, which you pay for only once for your property, you will be protected against several nightmare scenarios; you will be protected against title defects that could impact your property.

What Is Title Insurance?

Title insurance protects your title and allows you to avoid charges if you encounter any issues with your title. This type of insurance also protects you against several risks, in spite of any prior verifications made by the notary and land surveyor at the time of the purchase. It is not impossible for other problems to arise with items that are beyond the control of professionals or outside the scope of their verifications.

Some of the protections from which you benefit by holding title insurance include:

Some of the protections from which you benefit by holding title insurance include:

- Property fraud and identity theft

- Encroachment issues

- Legal fees and legal defence costs in the event of real estate lawsuits

- Over 30 other risks

When you hold title insurance, such as Abri’s coverage, all you need is to objectively demonstrate that the damage was incurred in connection with one of the coverage under the title insurance policy. In other words, you do not have to prove any fault and all expenses are covered by the insurer. If an error is committed by one of the professionals involved in your property transaction, without title insurance, you need to prove the fault and establish a causal link between the professional responsible and the damage sustained. To prove fault, you have to prove that the professional’s error or omission was the reason for the damage. To prove this causality, you have to hire the services of a lawyer. This can quickly add up and result in hundreds or even thousands of dollars in fees.

What Is Abri Title Insurance?

Abri was launched in the fall of 2019, and our online tool now allows you to quickly find out how much your title insurance will cost. This is a one-time expense for your property that you won’t have to pay again in your lifetime. Even better! You can even offer title insurance as a gift to a loved one.

Title insurance is a simple and effective way to protect your real estate investment.

Use our online calculator to find the minimum premium for your property now. It’s quick and easy to use.

It’s reassuring to know there’s a way to protect your home without spending a fortune!